jbk_photography/iStock Editorial via Getty Images

Background and History

One of the most successful payment processing industries is MasterCard (MA). There is an established duopoly between the company and Visa (V) that has been very profitable. Payment system disruptions are expected to displace many legacy providers. The needed foray into DeFi technology has not been made by Mastercard. In this way, young DeFi companies can compete against legacy payment providers and build a blockchain-based payment ecosystem. There will be no credit cards in the new global ecosystem. Not only in the US, but around the world, companies are increasingly adopting digital payments. There are some hurdles for MasterCard to overcome, and the disruption and adoption of blockchain technology for everyday items and needs may be too much for it. Macroeconomically or fundamentally, legacy payments do not appear to be in particularly good shape.

The Growth Will Not Come

The future will not be kind to Mastercard. Even though the company has a variety of initiatives, I do not believe they will be enough to bring its infrastructure into the future. Currently, Visa is outcompeting Mastercard as Coinbase (COIN) has created a physical card that will allow users to pay for everyday items with cryptocurrency. This is a fantastic opportunity for the company. Still, it is not a long-term one because companies and the blockchain will eventually develop lower-cost solutions that will capture the majority of the market that legacy payment providers are trying to gain.

Mastercard 2021 Investor Day

I believe Mastercard could make a significant cultural and financial move and become a dominant player in a new world of decentralized finance. However, it needs a Meta (FB) level transformation from the top down to push new initiatives. This has yet to be seen, and until then, the investor base needs to remain somewhat grounded with the legacy payment business for some time.

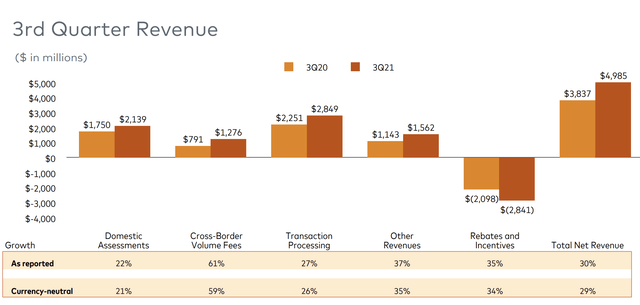

Mastercard Q3 2021 Earnings Presentation

Overall, the company reported third-quarter solid revenue results. There were substantial cross-border volume fees and a good 30% overall net revenue growth rate during the third quarter. These are good percentage gains, but they don’t even come close to reflecting the growth in various financial industries over the last year, especially ones that directly impact the payments industry. Cryptocurrency is one of those spaces that the company needs to venture into and catalyze that industry through its existing relationships and network. This is a distinct change from legacy to assimilate new trends, but a clear shift away from the legacy business needs to be. Keeping in mind the Meta example, the company essentially mastered monetizing Facebook, WhatsApp, and Instagram, and the company has now moved onto virtual reality, augmented reality, and related industries.

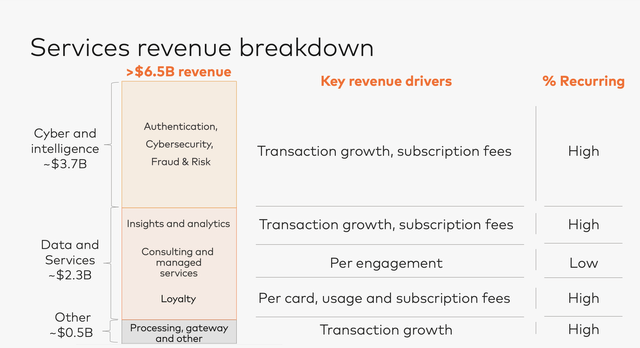

Mastercard 2021 Investor Day

The services revenue breakdown gives a better look at the specific growth drivers that Mastercard could face in the coming year. The cybersecurity and fraud detection systems that the company is internally developing have massive outside applications and could become valuable IPs in the future. Even though an array of companies offer cybersecurity for payments, Mastercard’s internal software is likely excellent and could compete with many small-cap public companies. Overall, I wouldn’t underestimate the value of this growth because these recurring growth drivers can be fundamental moving forward. However, investors must keep in mind that the services segment made up approximately 33% of overall revenue even with this exciting growth.

Operations Will Underperform Moving Forward

Overall, the core operations have been lackluster. Even though there are favorable growth rates, it is nothing compared to many other fin-tech names. There is a reason why Mastercard has a severe discount on other words such as Block (SQ) and PayPal (PYPL). Their growth rates are not the same, and their products don’t experience the same levels of growth. Both Venmo and Cash App have been operationally performing. Mastercard has also been performing, but not as well as the industry. This will be a concern moving forward.

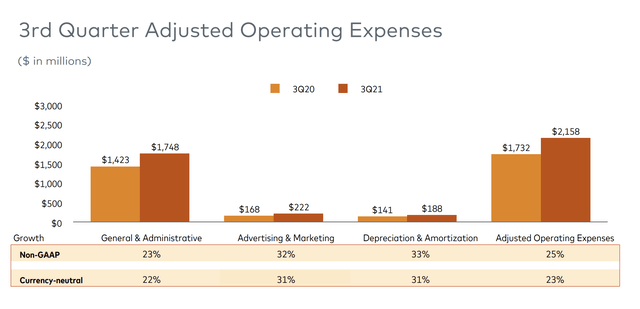

Mastercard Q3 2021 Earnings Presentation

Even though operating expenses have been rising, this has been partially due to inflation. Rising fixed costs are a necessary evil within the payment business due to inflation that causes higher fees. This also implies higher network costs, which will cause vendors and consumers to choose to switch to cryptocurrency-based payments universally. I’m aware that sounds crazy, but that is the future. There will be various stablecoin tethers to significant currencies that will initiate a whole new prediction market and an arbitrage market purely dedicated to these industries. While cryptocurrency is in early adoption, Mastercard still has the chance to make a significant shift. I believe in spinning off legacy assets and focusing the capital from those deals toward acquiring small cryptocurrency-based assets or growing their own. There are a variety of verticals the company can take; it’s just a question of whether they will or not.

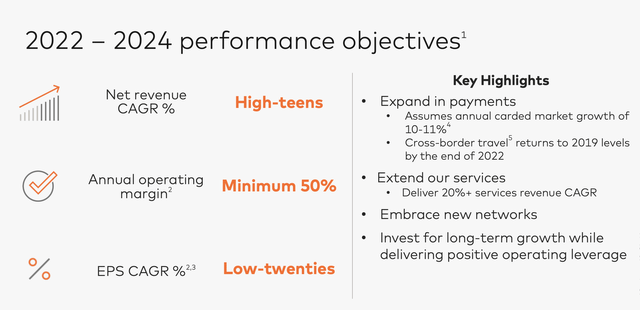

Mastercard 2021 Investor Day

The performance objectives for the company are admirable but currently out of reach; for Mastercard to reach these goals, they need to accomplish artificial and natural growth. Diving into cryptocurrency may be a way for Mastercard to achieve natural top-line growth that would grow investor enthusiasms. This would bring higher stock prices and give Mastercard more options for what to do with their stock. This channel can be immensely profitable and give them the operating margin they need to succeed.

The Stock is De-Risked for 2022 with Some Problems Looking Ahead

The stock, in my view, is de-risked for 2022. Rampant inflation has already been priced into the store. I see money managers’ continued flow into value as the focal point to Mastercard’s share price growth story in 2022. The primary risk to the company would be a decrease in consumer spending. However, over the past 24 months, betting against the consumer has been a bad trade, so I won’t fight the fen. I am not a firm believer in the core business due to the continued decentralization of finance and the emergence of blockchain technology. I believe the company should make these critical changes while they can, so they have a chance to stay solvent and liquid 10, 15, and 20 years down the line.

Valuation is at a Strong Point for Institutions and May Trend Higher

At current levels, the stock is undervalued. While I don’t believe there will be significant growth past 2022, at current levels, with strong consumer sentiment and increasing flow into the stocks, investors have a unique swing trade that could benefit their portfolio in the short term. A fair comparison would be to use the other two payment processing conglomerates, Visa and PayPal. These companies have a strong merchant payment processing business that drives revenues. PayPal is slightly more diversified and offers a more technical industry view. PayPal has the perfect combination of legacy payment-providing and Web3 exposure. Mastercard is in a poor position compared to peers past 2022.

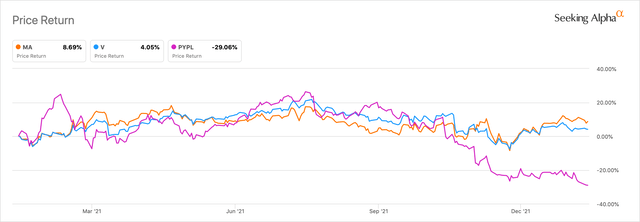

Seeking Alpha

The neutral price return of Mastercard can be explained very simply. In 2020, growth dominated, and Mastercard was viewed as a very stagnant stock. Visa and PayPal were also thrown in with this and had a very negative 2021. This is because of the constant fear surrounding the different waves of the pandemic. Traders predicted that the consumer would be less potent than it was. This has led to value compression in the industry overall.

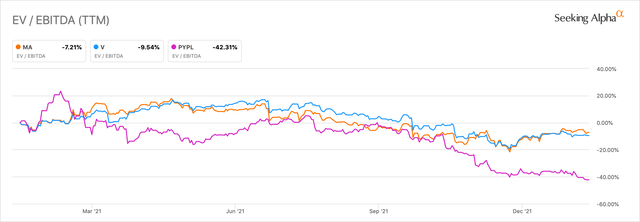

Seeking Alpha

There has been massive value compression for the payment processing industry. All three conglomerates reported stellar earnings. Institutions will view these prices as bargains and pile, which is why 2022 may be a strong year for these companies.

Conclusion and Rating

Mastercard is in a compromised position, and something needs to change. There are many reasons to be bearish on the stock, from the stagnant operational growth to the slow top-line growth and expanding expenses. However, the macroeconomic picture will prove a significant boon to the store. I look forward to analyzing the stock and seeing what happens in future earnings reports.