A wave of fundraising announcements and plenty of traditional players made headlines in the crypto market in April 2021 and the total market capitalization exceeded $1.9T, according to CoinGecko. “Saturday Night Live” touched on the subject of NFTs, which are getting more attention from the retail audience. Regulations, however, are paying more attention to the hype. It appears that broader adoption is getting closer, which is making the industry very excited.

Big financial brands wade further into crypto

Paypal will allow cryptocurrencies to be used for purchases. Under the hood, a crypto-to-fiat conversation will take place, ensuring that merchants actually receive fiat. Still, this could be a big step for broader cryptocurrency awareness efforts. Visa is going further and will actually be settling digital currency transactions on Ethereum using USDC. With the gas cost issues causing many projects and users to look for alternatives, this can be considered a big win for Ethereum.about:blank

Even institutionally facing projects are starting to look towards retail, as can be seen from Bakkt’s crypto payment application launch. Furthermore, Dharma’s DeFi integrations hint at future possibilities for retail users to get the benefits of DeFi. Competition for retail capital will only grow as even DeFi native applications become more retail friendly. For instance, after MetaMask integrated a swap feature into its wallet, it has processed $1B.Â

This dynamic may create a positive feedback loop. Retail users will bring more liquidity, which will strengthen and catalyze DeFi and in turn incentivize projects to take further steps to make the industry more accessible to retail users.

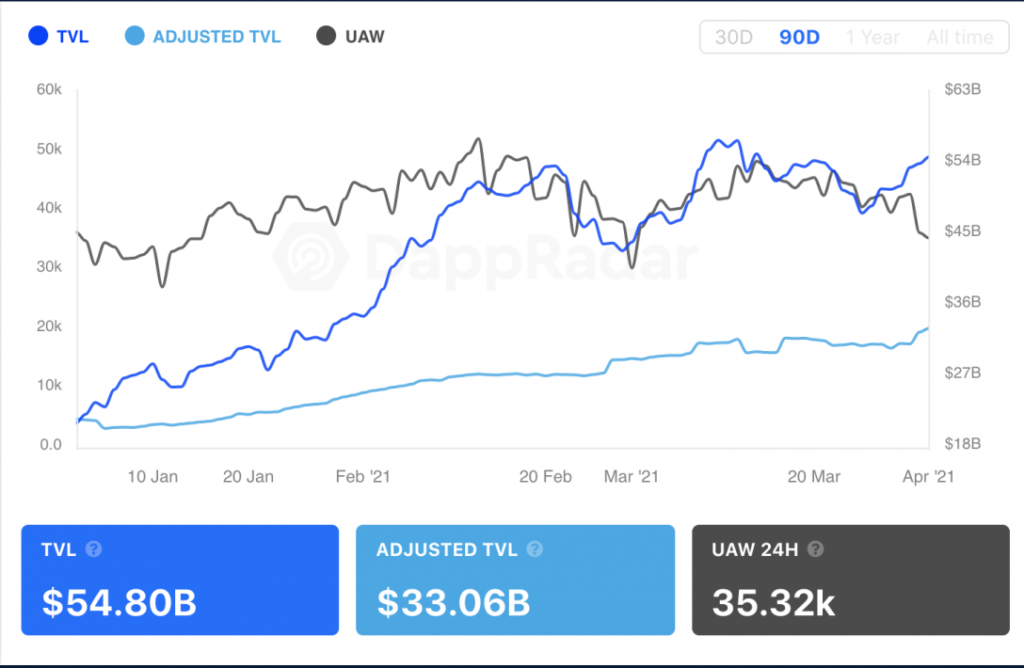

DeFi continues to make strides

It looks like Aave and Zapper will be coming on to Polygon. With Ethereum’s fees remaining a major obstacle for growth, DeFi applications are forced to consider alternatives. The choice of Polygon is interesting. Polygon is an evolution of Matic Network, which previously found some success in attracting gaming projects to its L2 solution. If Polygon starts to gain momentum attracting DeFi projects it may change the competitive landscape for Ethereum L2s. While projects may choose to integrate with multiple solutions, Polygon may be able to establish some sort of networking effects if it is able to attract enough projects.

The market didn’t have to wait long after Uniswap’s v3 announcement before SushiSwap launched Kashi. The specialized lending platform further differentiates the two AMM ecosystems. SushiSwap may have started as a fork, but it is a different project now.

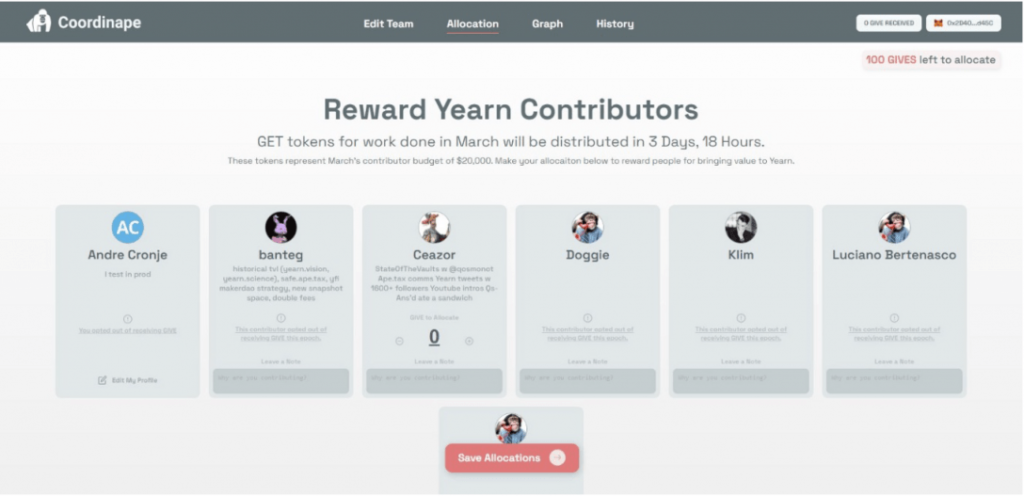

The Yearn ecosystem continues to evolve. Its new platform “Coordinapeâ€Â will help to facilitate the allocation of the DAO’s grant funds. Efficient distribution of capital may increase the growth and development of the ecosystem that is already one of the key components of the DeFi sector.

However, growth in the sector has not been seamless. As the recent Delta – Uniswap debacle has shown, there is a lot of work to be done as far as performance tracking and analysis. DELTA token activity resulted in a suspect spike in Uniswap trading volume, and Uniswap stopped tracking DELTA as part of its Uniswap.info statistics. With Uniswap being one of the most liquid DeFi applications in the market, such data fluctuations could be dangerous, particularly if these data points are used by traders.

Money flows into NFTs

There were a number of big capital raise announcements pertaining to the NFTs. Enjin announced an $18.9M round to enter the Polkadot ecosystem and build a parachain for NFTs. SuperRare attracted $9M in its Series A, while Recur brought in $5M to focus on cross-platform royalties for NFTs. However, the biggest funding announcement came from Dapper Labs, which raised $305M.

This latest round by Dapper Labs combined with the success of NBA Top Shot makes Flow a serious contender for the number one spot as an L1 as far as NFTs are concerned. This development should further solidify the notion of the multi-chain future.

Competition for NFTs

NFTs have been growing in popularity and awareness and different ecosystems are now trying to establish their viability in regards to this technology. Polkadot and Flow were mentioned above, but they are far from being the only ones to make moves. ConsenSys also threw its name in the hat with the Palm platform. While it may be new, it has been quick to make a splash by securing the launch of Damien Hirst’s “The Currency Projectâ€, and the deployment of Unsiwap’s v3 instance.

Justin Sun announced JUST NFT Fund, a fund focused on high-value art in the NFT space. The move may be an attempt to attract attention to the Tron network as an ecosystem for artists and collectors. Klaytn is also looking to become more active and has partnered with OpeSea.

Regulators are taking a closer look at NFTs

Recent comments from SEC Commissioner Hester Peirce suggest that securities regulations are relevant for NFTs as well, and some actions like sharding may actually create securities, which would potentially make shards on NIFTEX unregistered securities. FATF has also recently updated its guidance to call for applying AML and KYC standards to NFTs.

The crypto market has experienced shocks in the past stemming from regulatory uncertainty and/or trying to deal with the evolving regulatory landscape. Previously, much of the focus rested on fundraising activity and financial operations, but it looks like regulators are starting to expand their scope.

NFT coming to the physical realm

With crypto art garnering more attention, there appears to be greater demand for displaying it in a more traditional way. Superchief will be opening a gallery in New York that will showcase NFTs, and for those looking for an at-home solution, Qonos is looking to provide digital frames tailored for that.

It is important for art to be viewed, and as crypto art bridges into the physical world its presence may accelerate awareness and discovering more about NFTs and the crypto industry as a whole.

The information provided here is for informational purposes only. This is not investment advice and should not be treated as such. Strategic Round Capital and/or the author of this article holds a position in BTC, ETH, AAVE, USDC, YFI.

See Post HERE